Blue Owl Capital Inc. stands out as a premier asset manager, specializing in alternative investments with a substantial $157 billion in assets under management. This remarkable achievement is managed across three primary platforms: Credit, GP Strategic Capital, and Real Estate. The company’s commitment to private capital solutions is evident in its mission to foster long-term growth for businesses while offering unique investment opportunities to both institutional and individual investors.

Design and Structure of Blue Owl’s Presentation

The presentation’s design is meticulously crafted to ensure clarity and impact. Using a clean and professional layout, the structure is highly organized to guide the audience through the core components of Blue Owl’s operations. Each section is distinct yet connected, allowing for a seamless flow of information that highlights the firm’s strategic initiatives and accomplishments.

Blue Owl’s presentation structure effectively breaks down complex investment strategies into easily digestible parts, ensuring that both seasoned investors and newcomers can appreciate the value offered. The strategic use of headers and subheaders directs attention to critical points, ensuring that key messages are absorbed with ease.

Visuals and Messaging

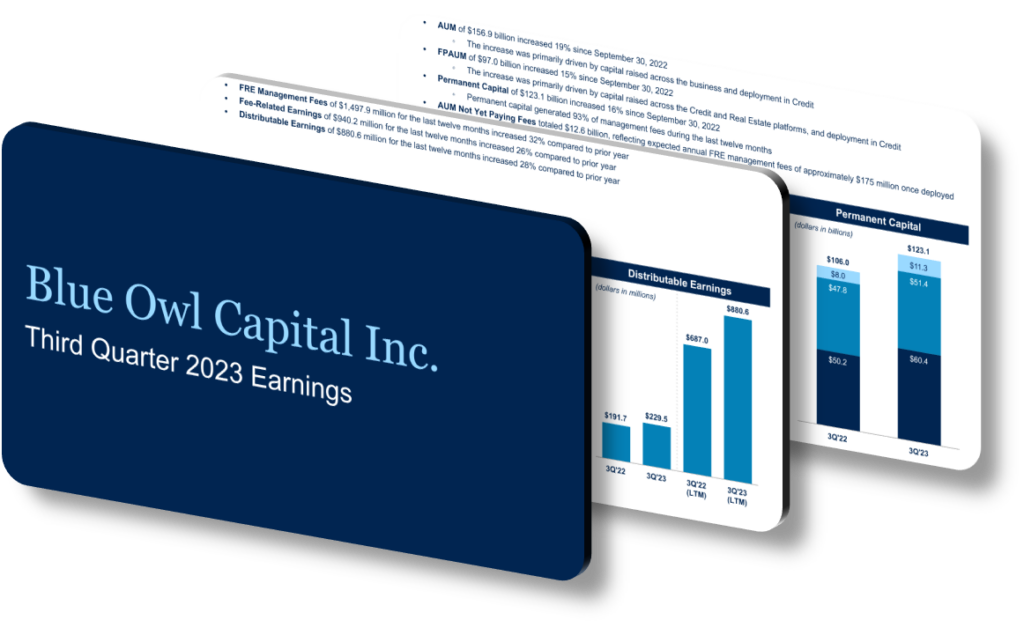

Visual elements play a crucial role in Blue Owl’s presentation, complementing the content and reinforcing the company’s message of growth and leadership in alternative investments. Infographics and charts are used extensively to illustrate asset growth, fee-related earnings, and strategic acquisitions. These visuals provide an instant understanding of Blue Owl’s robust performance metrics, making complex data more accessible.

The messaging throughout the presentation is consistently positive, focusing on the firm’s disciplined approach and innovative strategies. By emphasizing these strengths, Blue Owl effectively communicates its position as an industry leader, driving value for clients and stakeholders alike. The integration of testimonials and case studies further enhances credibility, showcasing real-world success stories that align with Blue Owl’s strategic objectives.

Core Content and Strategic Initiatives

In the third quarter of 2023, Blue Owl reported significant growth in assets under management and fee-related earnings. These achievements are a direct result of successful capital-raising efforts and strategic acquisitions. The firm’s expansion within the alternative asset management ecosystem is particularly notable, with remarkable increases in its Credit and Real Estate platforms.

Blue Owl’s disciplined approach to investment and its focus on innovative strategies have positioned the company as a leader in the industry. This leadership is not only reflected in its financial metrics but also in its dedication to delivering strong performance, risk-adjusted returns, and capital preservation for its clients. The firm’s robust permanent capital base and a global team of over 650 professionals underscore its capacity to manage and grow investments effectively.