Design and Structure: Clarity and Impact

The Q4 2023 Investor Update presentation by Slate Grocery REIT delivers a comprehensive overview of the company’s strategic focus on grocery-anchored properties. With an impressive portfolio of 117 properties spread across 24 U.S. states, this presentation effectively highlights the company’s commitment to essential retail real estate, emphasizing the enduring resilience and stability of grocery-anchored assets.

Visuals: Enhancing Understanding

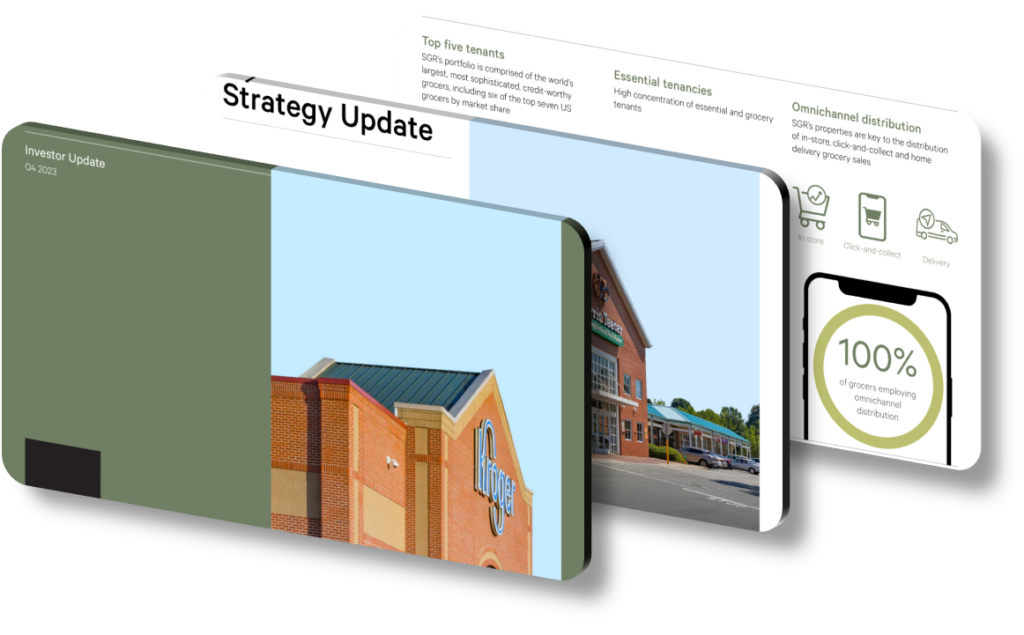

Visual aids, such as charts and infographics, are effectively utilized throughout the presentation to emphasize the resilience of Slate Grocery REIT’s assets. For instance, graphs depicting historical income stability of grocery-anchored properties during economic downturns are particularly impactful. These visuals not only enhance comprehension but also reinforce the message of stability and growth potential.

Messaging: Strategic Focus and Growth

The core messaging of the presentation revolves around Slate Grocery REIT’s strategic focus on the rapidly growing U.S. Sunbelt region. By highlighting their significant presence in this area, the presentation underscores the company’s ability to capitalize on increasing retail sales and strong tenant demand. This strategic positioning supports ongoing rent growth and maintains low vacancy rates, which are key factors in the company’s growth narrative.

Core Content: Operational Excellence and ESG Commitment

Slate Grocery REIT’s operational excellence is clearly demonstrated through significant leasing volumes and strong rental spreads, showcasing the company’s proactive approach to property management. Additionally, the presentation emphasizes their commitment to ESG initiatives, including the integration of green lease language and sustainability efforts. These initiatives not only enhance property value but also align with investors’ growing interest in sustainable investments.

Financial Flexibility and Future Growth

Another critical aspect covered in the presentation is the solid financial foundation of Slate Grocery REIT. With proactive debt management and a strong balance sheet, the company is well-equipped to pursue high-quality, accretive acquisitions. This financial flexibility ensures long-term growth and value creation for investors, positioning Slate Grocery REIT as a leader in the grocery-anchored real estate market.

Conclusion: A Vision for Stability and Growth

In conclusion, the Q4 2023 Investor Update presentation effectively communicates Slate Grocery REIT’s strategic focus on grocery-anchored properties. Through its well-designed structure, compelling visuals, and clear messaging, the presentation underscores the company’s resilience, operational excellence, and commitment to sustainable growth. With a solid foundation and strategic positioning, Slate Grocery REIT is poised to deliver long-term value and stability to its investors, making it an attractive proposition in the retail real estate sector.