Strategic Design and Structure

The recent announcement of LKQ Corporation’s acquisition of Uni-Select marks a significant milestone in LKQ’s strategic expansion efforts. This acquisition is not merely a business transaction; it is a carefully designed move poised to elevate LKQ’s market presence, particularly across North America. The presentation of this strategic initiative was meticulously crafted to highlight the potential benefits and synergies expected from this acquisition.

The presentation was structured to guide the audience through the strategic rationale behind the acquisition, starting with an overview of both companies’ current operations and market standings. By laying a solid foundation, the presentation effectively explained how Uni-Select’s complementary operations, including its FinishMaster paint distribution business, align with LKQ’s mission to be a leading global distributor of vehicle parts and accessories.

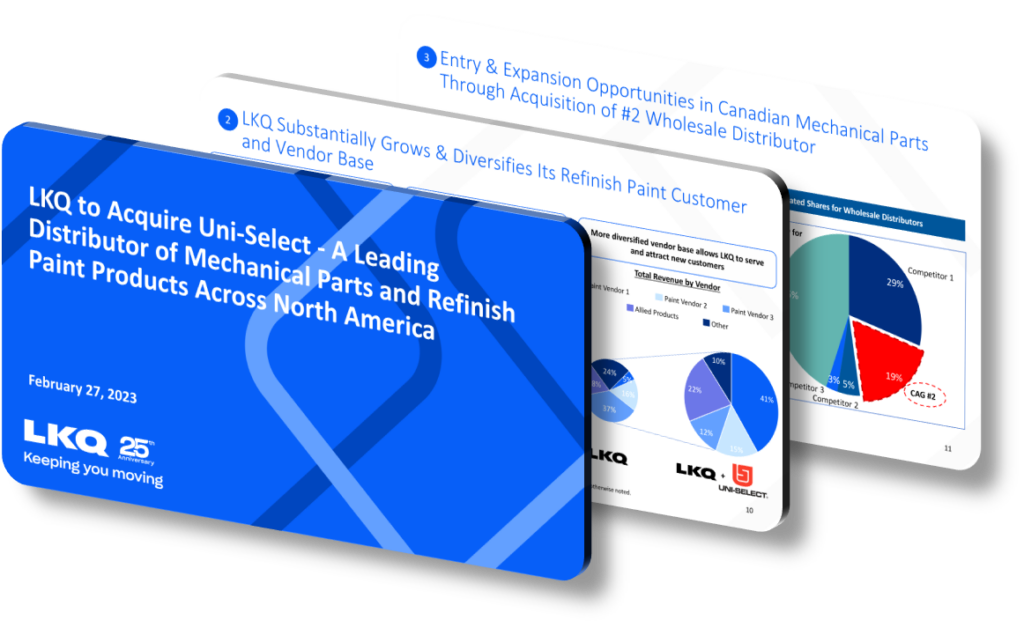

The presentation emphasized the expected synergies and growth prospects, illustrating how the acquisition would drive profitable growth and expand LKQ’s market presence. The strategic design of the presentation ensured that stakeholders could easily understand the benefits of the acquisition, such as:

- Enhanced North American product offerings.

- Scalable entry into the Canadian mechanical parts sector.

- Incremental revenue growth and margin expansion opportunities.

Impactful Visuals and Messaging

Visual aids played a crucial role in conveying the message clearly and impactfully. Charts and graphs highlighted projected revenue growth and margin expansion, making complex financial data accessible and engaging for the audience. These visuals underscored the transaction’s expected accretion to LKQ’s adjusted earnings per share in the first year post-closing, reinforcing the financial benefits of the acquisition.

Messaging was carefully crafted to focus on the positive impact of the acquisition on LKQ’s competitive positioning. The presentation highlighted the company’s commitment to maintaining investment-grade credit ratings and achieving targeted leverage reductions within 18 months, which reassured stakeholders of LKQ’s financial stability and strategic foresight.

Core Content and Future Outlook

The core content of the presentation revolved around the strategic alignment between LKQ and Uni-Select, showcasing how the acquisition supports LKQ’s mission to offer a comprehensive, cost-effective selection of parts and service solutions. By integrating Uni-Select’s operations, LKQ is poised to bolster its product mix, enhance distribution capabilities, and ultimately deliver greater value to customers across North America.

The transaction has received unanimous approval from both companies’ boards and is anticipated to close in the second half of 2023, subject to customary regulatory and shareholder approvals. This timeline highlights the thorough planning and due diligence conducted by LKQ to ensure a smooth transition and integration process.

Conclusion

In conclusion, LKQ Corporation’s acquisition of Uni-Select is a strategic move designed to strengthen its market presence and drive sustainable growth. The presentation effectively communicated the strategic, financial, and operational benefits of the acquisition through a well-structured narrative, impactful visuals, and positive messaging. This acquisition not only aligns with LKQ’s long-term goals but also sets the stage for continued success in the competitive North American market.