Process

Simple, efficient presentation design process

01

Ideation

Through a kick-off call, we gain an understanding of your goals, laying the groundwork for a successful project.

02

Interpretation

Our designers work

their magic in the visual development phase,

turning your ideas into stunning visuals.

03

Iteration

To meet your expectations,

we keep an iterative, collaborative feedback cycle to refine your project.

04

Implementation

We conduct rigorous quality checks for accuracy, brand consistency, and compatibility before the final delivery.

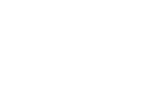

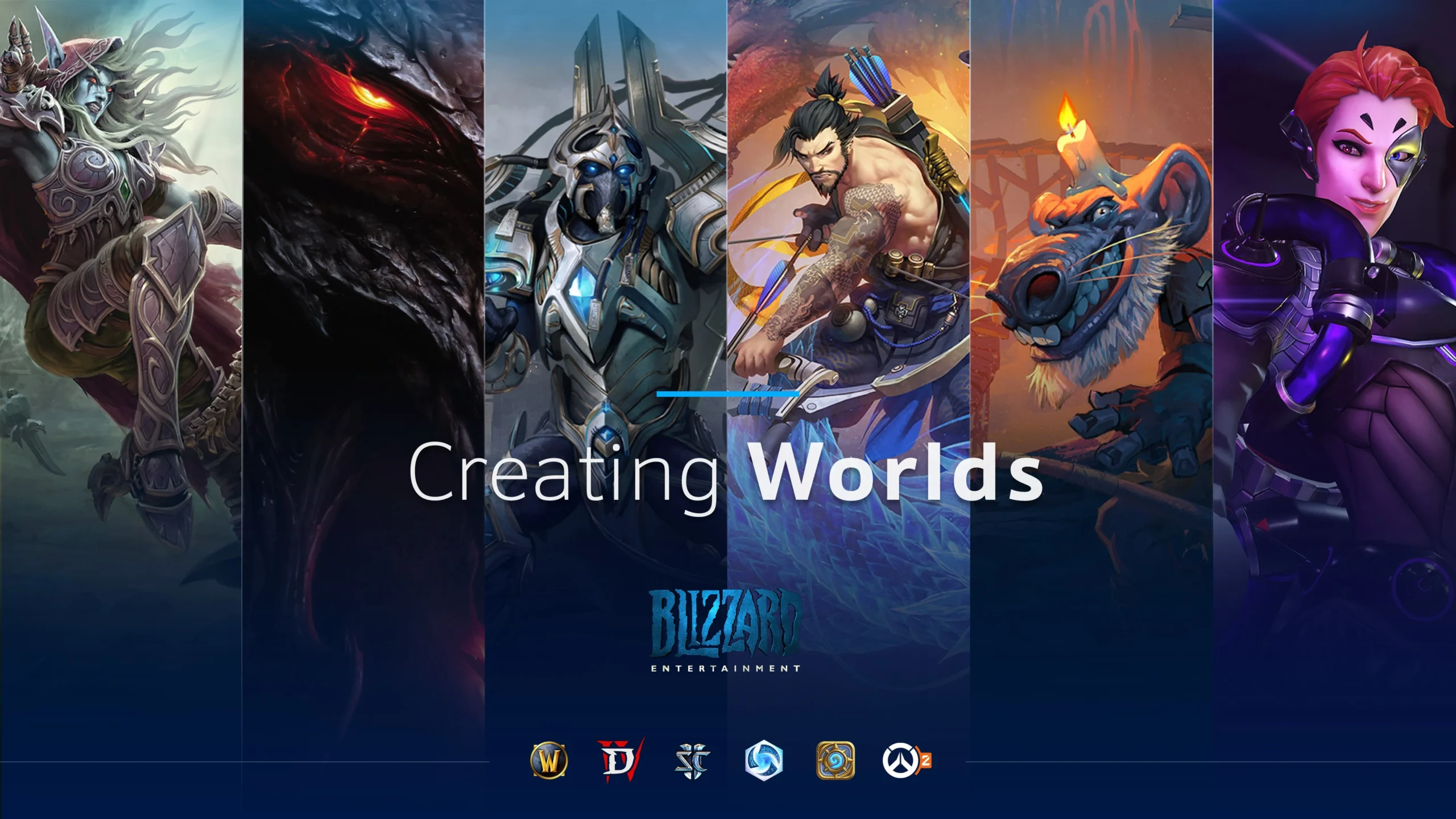

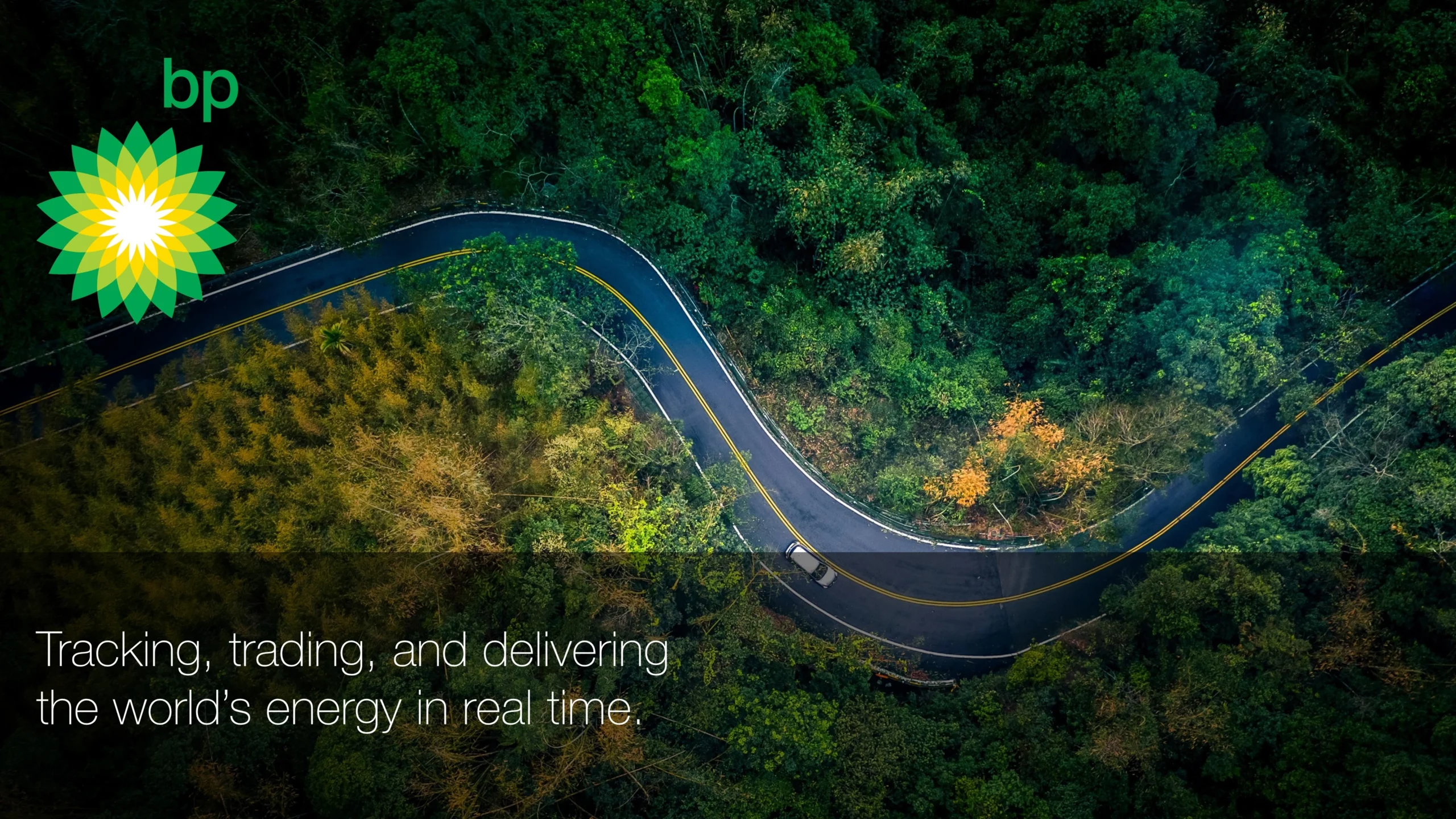

Portfolio

Explore our latest work

Services

Start your next project with us

Don’t see what you’re looking for?

Solutions

Get tailored solutions for your business

Sales

Enablement

Captivate and convert your target audience through visually engaging, persuasive sales enablement decks.

Financial

Communications

Simplify complex financial data through data visualization for improved engagement

and understanding.

Conferences

& Events

Elevate presentations, enhance brand presence, and create a memorable and impactful experience for attendees.

Sales

& Pitch Decks

Stand out, win business, and secure investments with visuals that communicate your message successfully.

Marketing

Communications

Supplement marketing efforts with stunning presentations for customer acquisition and retention, brand awareness, and

business growth.

Internal

Communications

Improve internal communication with visual presentations for employee engagement and alignment with organizational goals.

Services

Deliver your message in other visual formats

Our additional design services let you maximize your information and ideas.

Let’s collaborate to achieve your goals.