Impactful Design and Structure

The presentation of the report is meticulously structured to guide readers through complex data with ease. By segmenting the report into clear, distinct sections, it allows for an organized exploration of fund flows across various asset classes. This structured approach not only enhances readability but also ensures that the audience can quickly locate specific information, making the report a valuable tool for investors and analysts alike.

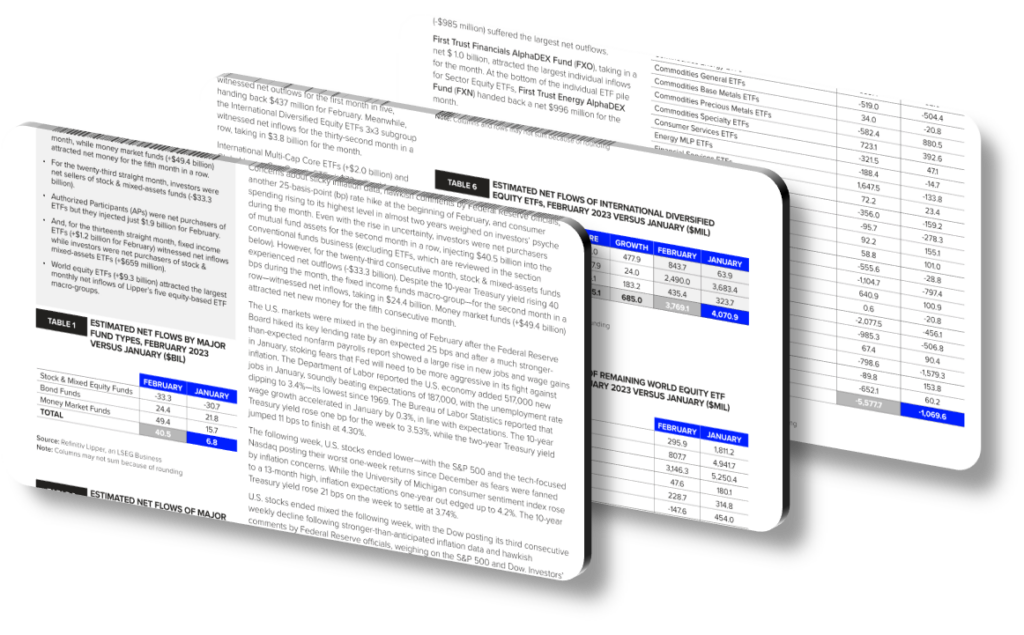

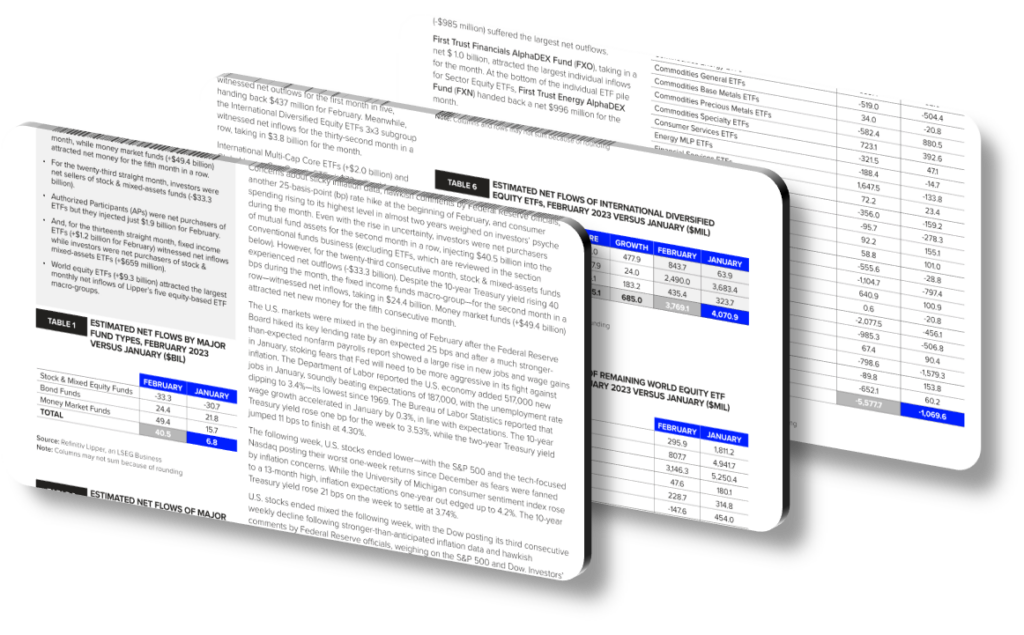

Effective Use of Visuals

Visual elements play a crucial role in the report, transforming complex data sets into easily digestible graphics. Charts and graphs are strategically used to illustrate key trends, such as the significant inflows into fixed income and money market funds, and the outflows from stock and mixed-assets funds. These visuals not only enhance comprehension but also engage the audience by presenting data in a more compelling and accessible format.

Clear and Impactful Messaging

The messaging throughout the report is clear and focused, emphasizing the mixed sentiment among investors while highlighting areas of growth and opportunity. The report acknowledges the cautious approach taken by investors, especially in equity markets, yet underscores the strategic inflows into fixed income and money market funds, showcasing investor adaptability and foresight.

Highlights from the Report:

- Fixed Income and Money Market Funds: Significant inflows, indicating a preference for safer investment options amid economic uncertainties.

- Stock and Mixed-Assets Funds: Continued outflows, reflecting cautious investor behavior towards equities.

- ETFs: Modest net inflows, with World Equity ETFs remaining popular despite outflows in other categories.

- Top Attractors: Vanguard and JPMorgan stood out, driven by their low-cost equity and bond offerings.

Core Content and Investor Strategies

The core content of the February 2023 report provides a comprehensive overview of fund flows across various asset classes. It reflects a cautious yet strategic approach by investors as they navigate the current economic landscape. By highlighting the popularity of money market and fixed income funds, the report suggests a shift towards more stable investment vehicles, aligning with a broader trend of risk-averse strategies during uncertain times.

The report’s insights into ETF trends also reveal strategic positioning, with investors favoring certain global equities over domestic options, showcasing a diversification strategy designed to mitigate risk while capturing growth opportunities.

Conclusion

In summary, the February 2023 Refinitiv Lipper Fund Flows Insight Report stands out not only for its valuable content but also for its effective delivery through design, structure, and messaging. By providing a clear and comprehensive analysis of investor sentiment and fund flows, the report serves as an essential resource for understanding the financial market dynamics during a period of economic uncertainty.

For investors and financial professionals, these insights offer guidance in crafting informed investment strategies that balance caution with opportunity, navigating the complexities of the market with confidence and clarity.