Strategic Design and Structure

The design and structure of the FPA New Income Fund are tailored to align with its core mission: providing stability and income while managing various risks. The fund adopts a diversified strategy by investing across a broad spectrum of fixed-income securities, including:

- Asset-backed securities

- Collateralized loan obligations

- Corporate bonds

- Government securities

This diversification is vital in mitigating risks associated with interest rates, credit quality, and market volatility, thus ensuring consistent performance. The fund’s active management strategy allows for adaptive changes based on market conditions, enhancing its ability to seize investment opportunities as they arise.

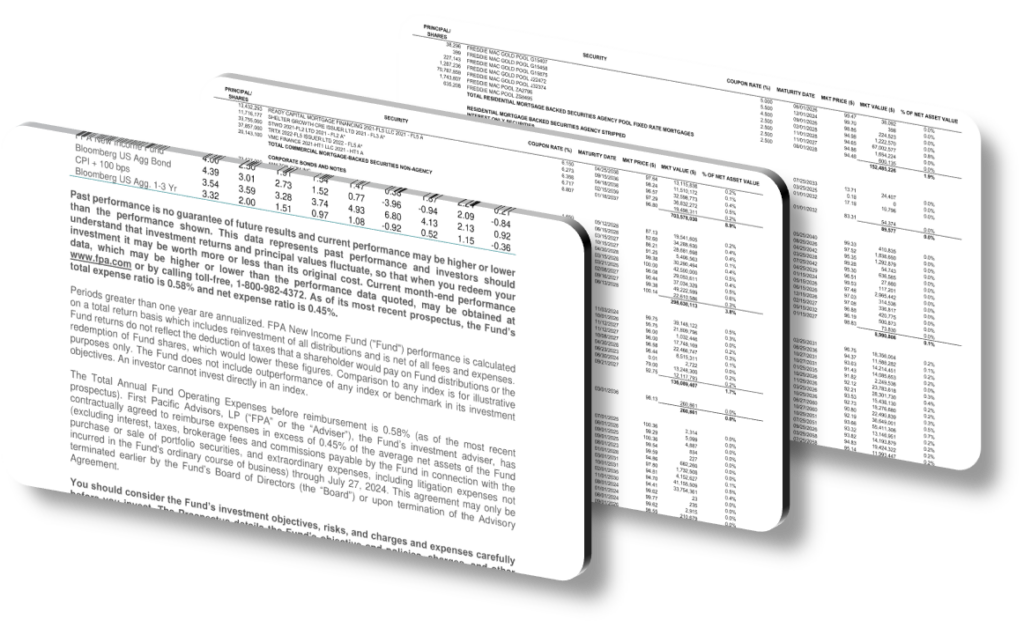

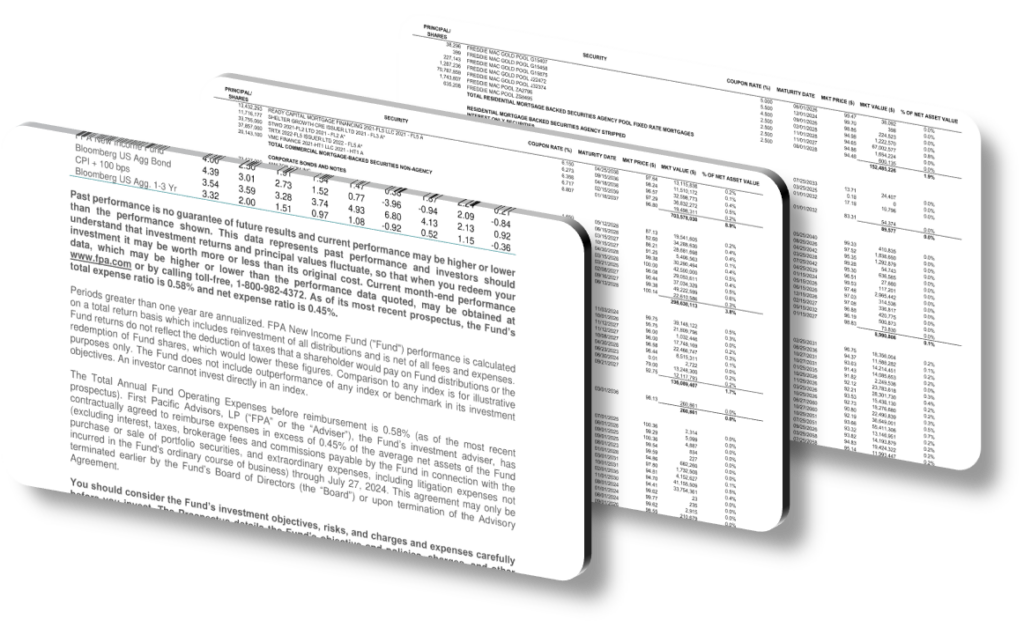

Visual Presentation and Messaging

The fund’s presentation is visually engaging, utilizing graphs, charts, and infographics to effectively communicate complex data and performance metrics. These visuals are crucial for illustrating the fund’s performance relative to benchmarks such as the Bloomberg US Aggregate Bond Index and the Consumer Price Index plus 100 basis points.

The messaging is clear and positively focused, emphasizing the fund’s commitment to competitive expense ratios through a contractual reimbursement agreement. This ensures that expenses exceeding a certain threshold are covered, adding an extra layer of attractiveness to potential investors.

Core Content and Performance

At its core, the FPA New Income Fund is designed for investors who are looking for a balanced approach to income generation and capital preservation. By continuously updating performance data on a monthly basis, available via the FPA website or customer service, the fund maintains transparency and builds trust with its investors.

Investors are encouraged to review the fund’s prospectus for a comprehensive understanding of its objectives, risks, and expenses. This document is pivotal in providing detailed insights into the fund’s operational ethos and investment strategies, further reinforcing the fund’s commitment to informed investing.

Conclusion

In conclusion, the FPA New Income Fund effectively delivers consistent returns through its strategic design, diversified structure, and clear, impactful messaging. The fund’s emphasis on stability and risk management, combined with its commitment to transparency and competitive expense management, positions it as a reliable choice for investors seeking steady income and capital preservation.

By leveraging a wide array of fixed-income securities and actively adjusting its portfolio to align with market dynamics, the FPA New Income Fund exemplifies a forward-thinking approach to investment management.